Would You like a feature Interview?

All Interviews are 100% FREE of Charge

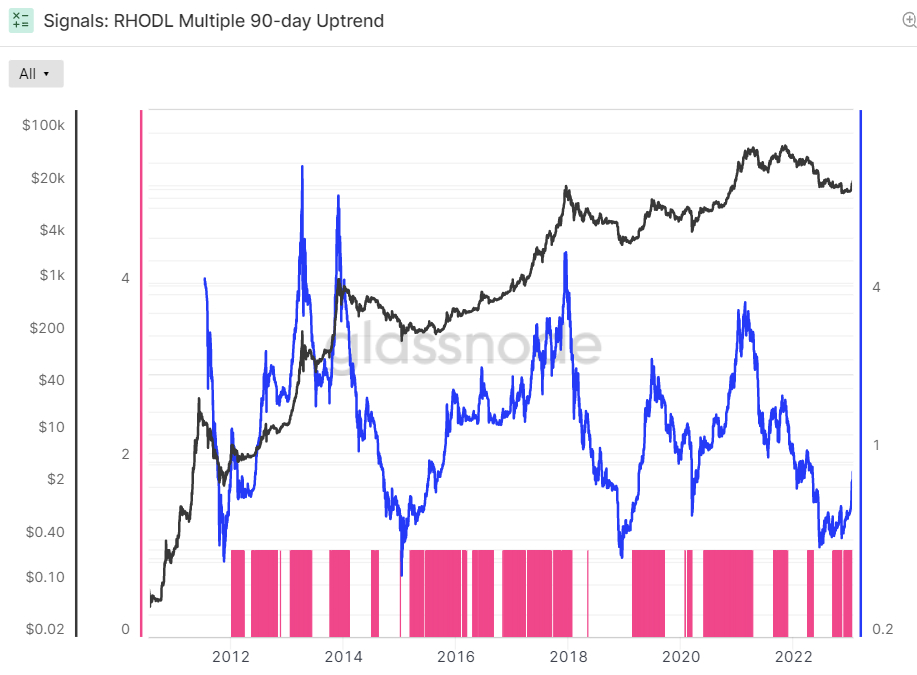

Bitcoin’s 90-day realization HODL multiple is the highest since May 2022, when the price of Bitcoin was around $30,000, as opposed to current levels in the high $22,000s, according to data from crypto analytics firm Glassnode. level has risen. Realize HODL Ratio (RHODL) is the ratio of the number of Bitcoins moved within a week to the number of coins moved 1-2 years ago.

According to Glassnode, a high value indicates a predominance of 1-week-old coins, while a low value indicates a predominance of 1-2 year old coins. The realized HODL multiple is an oscillator calculated by dividing her current RHODL by the Simple Moving Average (SMA) of his RHODL over the last 365 days.

“If RHODL multiples move to an uptrend in the 90-day window, it indicates that US dollar-denominated wealth is starting to return to the influx of new demand,” the crypto analytics firm said. It “indicates that profits are being taken and the market can absorb them …[and]that long-term holders are starting to spend the coin,” said Glassnode.

The RHODL multiple hovered around 0.85 after falling below 0.5 in June 2022. Historically, if the RHODL multiple recovers from below 0.5, this is a good indicator of an upcoming Bitcoin bull market.

What does this mean for BTC?

The rise in the RHODL multiple comes as bitcoin’s price rises nearly 40% so far this month, as the world’s largest cryptocurrency by market capitalization aims for its best monthly performance since October 2021. . High $22,000s as traders, analysts, and investors ponder whether the latest rally is the beginning of a long-term rally or a so-called “bear market trap.”

Also, the recent positive change in Glassnode’s RHODL metric comes at a time when other indicators are also pointing to potential bottoms. Bitcoin recently surpassed the 200-day SMA and realized price. Both are seen as very significant levels, with sustained breaks either north or south that are often seen as indicative of a shift in Bitcoin price momentum.

Meanwhile, Glassnode’s New Addresses Momentum and Realized Bitcoin P&L Ratio are also trending upwards. Several indicators are also trending upward. Elsewhere, Alternative.me’s Bitcoin Fear and Greed Index recently bounced back to neutral (above 50). If it can sustain above 50 levels sustainably, this has historically typified the end of a bear market.

A macro tailwind in 2023?

More broadly, the macro picture looks better than in 2023. Much of the Fed rate hike appears to have already happened as US inflation has fallen sharply to the central bank’s target of 2.0% and US growth has slowed significantly. In fact, the macro trader is increasingly betting on a more favorable interest rate environment from late 2023 through he said to 2024.

In other words, the main drivers of the 2022 bear market (more hawkish than the Fed expected) look (so) less of an issue in 2023. Bitcoin’s downside risk seems to have decreased compared to this time last year, especially if the upcoming US recession turns out to be worse than expected and causes US stocks to fall.

In the short term, if Bitcoin is able to muster a push above the $23/$23,000 resistance, it will see a repeat of its late summer highs in the $25,500 area as part of a broader pushback to the $30,000 area. The door to testing is open.