Would You like a feature Interview?

All Interviews are 100% FREE of Charge

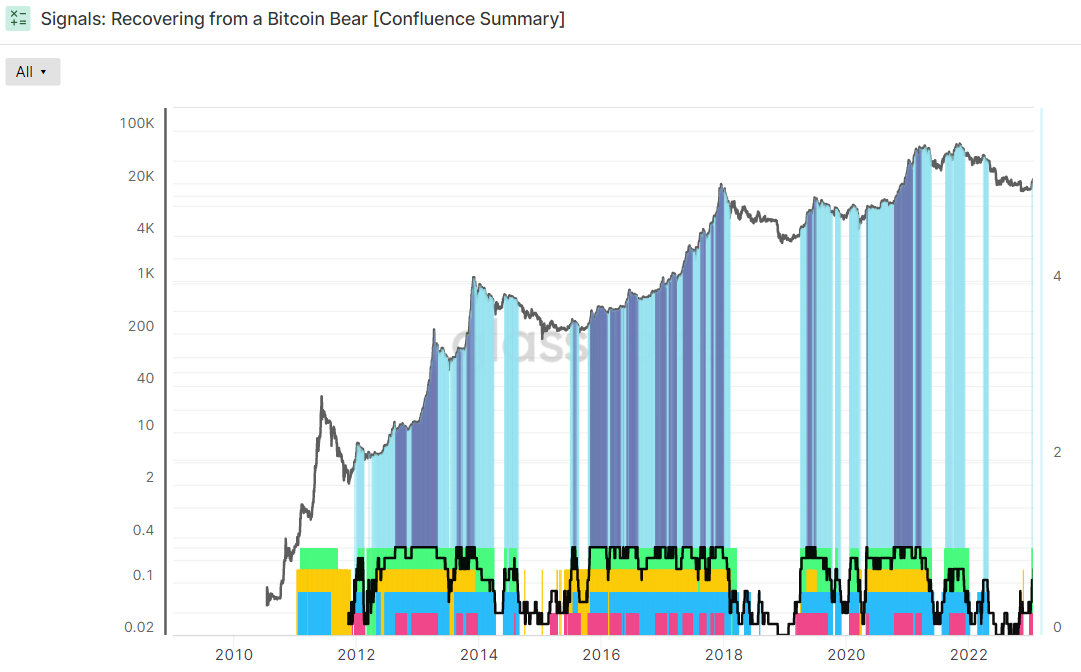

Six of the eight indicators observed by analysts at crypto data analytics platform Glassnode to identify when Bitcoin will exit a bear market show bullish signals, and the seventh will soon turn green as well. Most likely, Glassnode’s ‘Recovering from a Bitcoin Bear’ dashboard will help Bitcoin investors observe a mix of on-chain, technical, and network fundamental indicators to help the Bitcoin market grow healthier. It helps you identify when you’re headed for a trend.

Historically, at least 5 of these indicators flash green when the price of Bitcoin is rising. On the other hand, once all 8 indicators start flashing bullish signals, this has historically been an excellent buy signal. Conversely, if he has less than 5 of these indicators flashing green, then the price of Bitcoin is typically falling in the long run. Light blue indicates periods when at least 5 of the 8 bullish conditions were met. Dark blue indicates periods when all eight are filled.

Signals 1 and 2: Spot price trading above the main pricing model

Glassnode divides these metrics into four categories. First, Bitcoin is the dominant pricing model (200-day Simple Moving Average (SMA) and Realized Price, which is an on-chain indicator that shows the average price of each Bitcoin on the network when it last moved). ) is traded beyond (Average price “paid” when the wallet received bitcoins).

With Bitcoin’s 200 DMA at around $19,600 and a realized price of around $19,800, Bitcoin recently returned north of both of these major levels for the first time since December 2021. So both are flashing green.

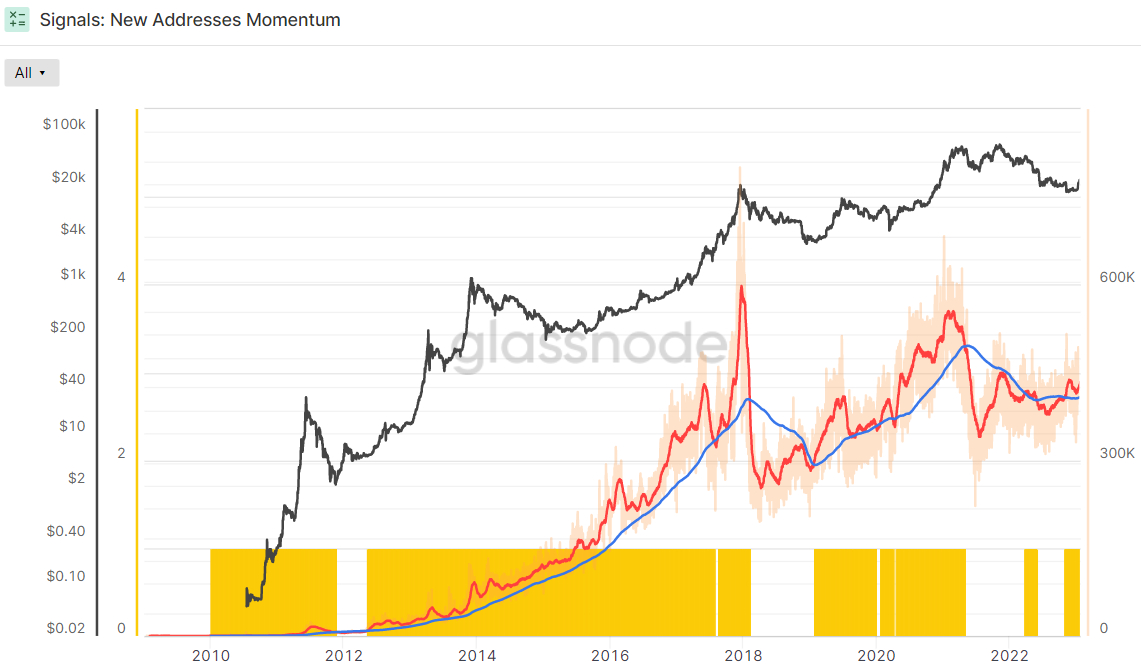

Signals 3 and 4: Network utilization is increasing

New Addresses’ 30-day SMA has recently surpassed its 200-day SMA and is flashing green. This has historically occurred at the beginning of bull markets.

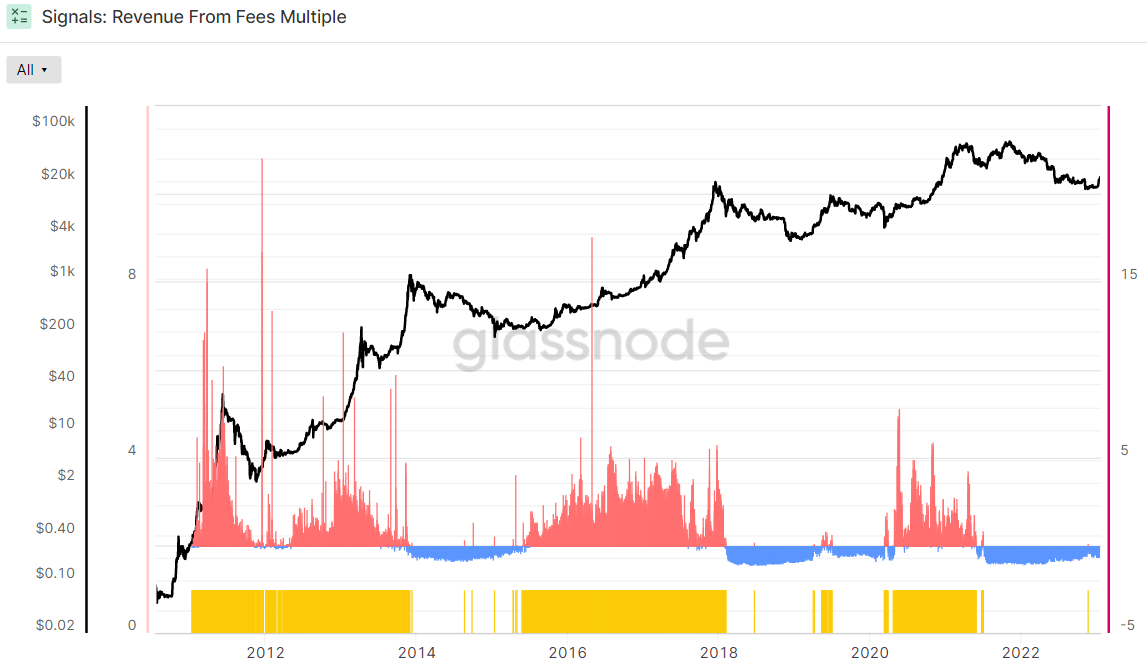

On the other hand, the 2-year Z-score for Revenue From Fees Multiple is still negative at around -0.33. A Z-score is the number of standard deviations above or below the mean of a data sample. In this example, Glassnode’s Z-score is the number of standard deviations above or below the average Bitcoin fee revenue over the last two years.

Therefore, this indicator is not yet flashing green. But as history shows, this can change very quickly.

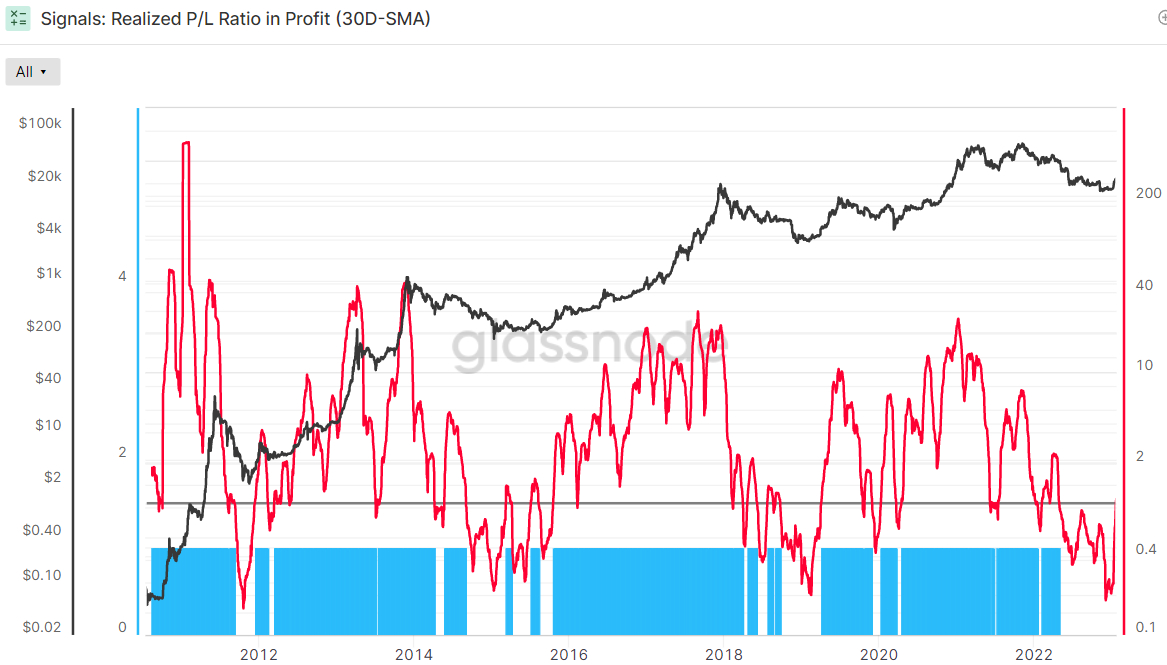

Signals 5 and 6: Market returns to profitability

The 30-day Simple Moving Average (SMA) of the Bitcoin Realized Profit-Loss Ratio (RPLR) indicator recently crossed above 1 for the first time last April. This means that the Bitcoin market is realizing more gains (in US dollars) than losses.

According to Glassnode, “This generally means that sellers with unrealized losses are exhausted and there is a healthier influx of demand to absorb profit-taking”. showing bullish signs.

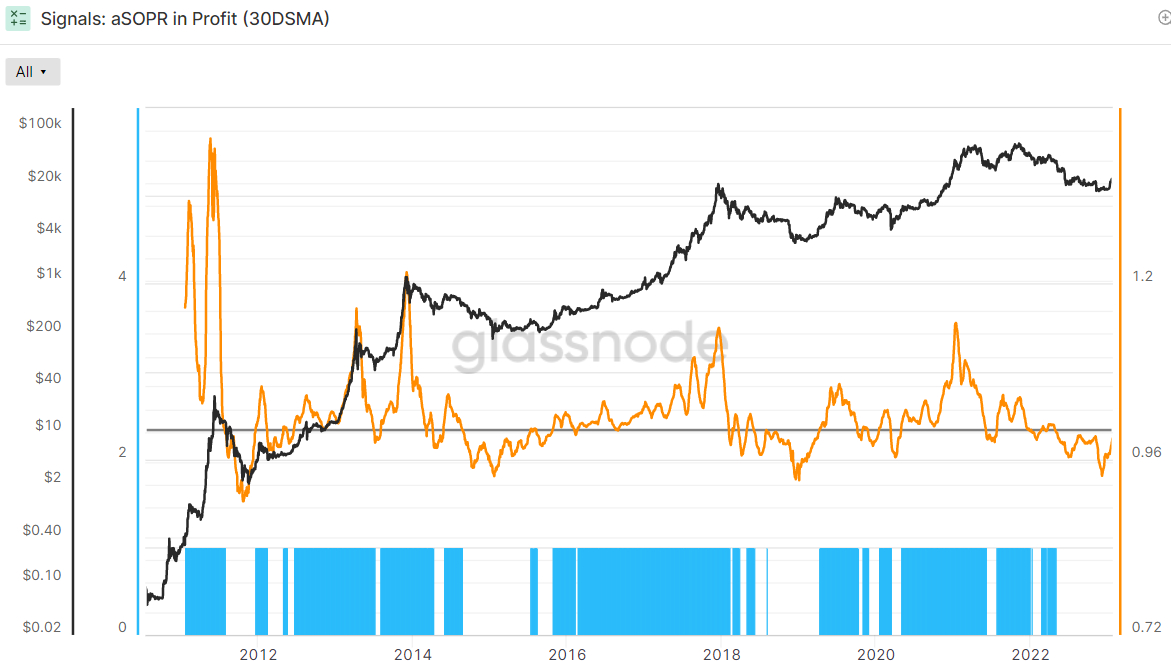

On the other hand, the adjusted return on consumption output (aSOPR), a metric that reflects the extent of realized gains and losses for every coin moving on the chain, remains below 1 (if the market is not yet making a profit). ), it is fast. It’s on the rise and looks likely to cross 1 soon. The last was 0.988.

This is the seventh indicator that has yet to send a bullish signal, but it could soon. Looking back over the last 8 years of Bitcoin history, aSOPR above 1 after falling below 1 was a great buy signal.

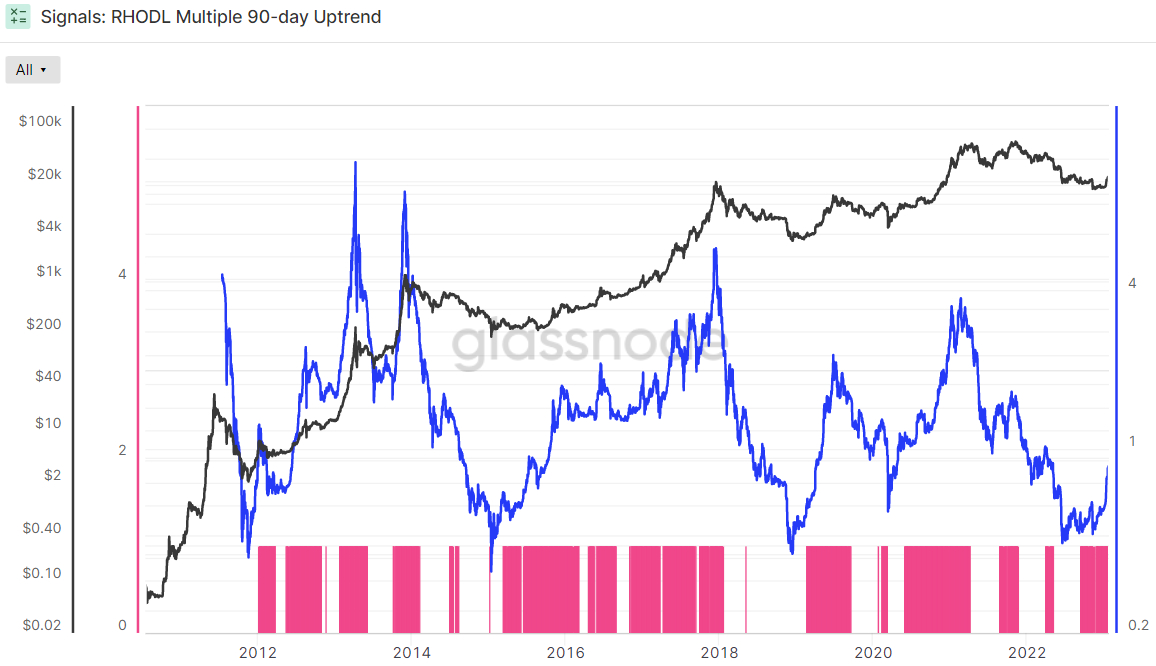

Signals 7 and 8: BTC Balance Moved in HODLer’s Favor

According to Glassnode, the Bitcoin Realized HODL Multiple has been trending upwards for the past 90 days, a bullish sign. “If RHODL multiples move to an uptrend in his 90-day window, it indicates that US dollar-denominated wealth is starting to return to the influx of new demand,” the crypto analytics firm said. This “indicates that profits have been taken and the market can absorb it …[and]that long-term holders are starting to spend the coin,” said Glassnode.

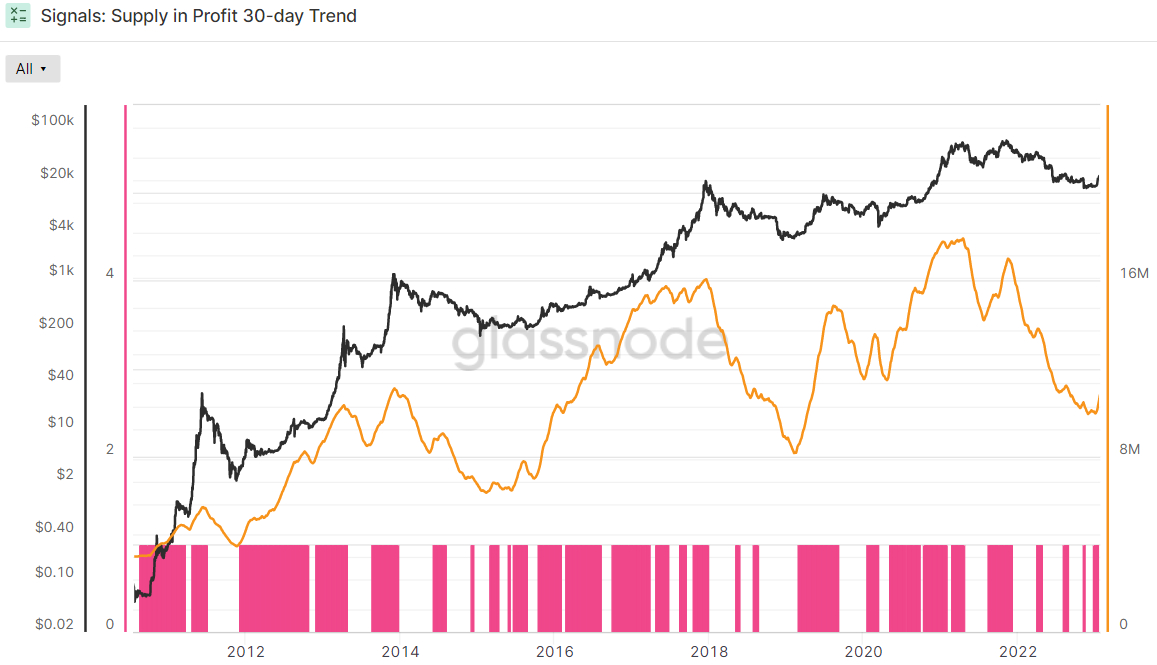

The final metric on Glassnode’s ‘Recovering from a Bitcoin Bear’ dashboard is whether the 90-day Exponential Moving Average (EMA) of the profit Bitcoin supply has trended upwards over the past 30 days. Profit supply is the last number of Bitcoins moved when the USD denominated price was lower than it is now, meaning it was bought at a lower price and the wallet held paper profits This indicator is also flashing green.

So are we in a Bitcoin bull market?

2022 macro headwinds It looks like it’s in decline. Recent survey data and corporate earnings show US inflation is falling rapidly to more acceptable levels and the US economy is nearing a halt. Evaluation of the bond market The view that the Fed will be unable to tighten further in 2023 looks increasingly accurate.

This narrative has been a major factor in Bitcoin’s 2023 rally so far, and many believe its price can be supported further in the coming months. continues to be derided as just a bear market rally, but the above indicators on Glassnode’s dashboard suggest that this latest rally could be much more than that.

And these aren’t the only on-chain indicators flashing signals that a bull market is coming. According to an analysis posted on Twitter by @GameofTrade_, six on-chain metrics, including Cumulative Trend Score, Entity Adjusted Dormant Flow, Reserve Risk, Realized Price, MVRV Z-score, and Puell Multiples, are the “long-term buys across generations. Seeking Opportunities”.

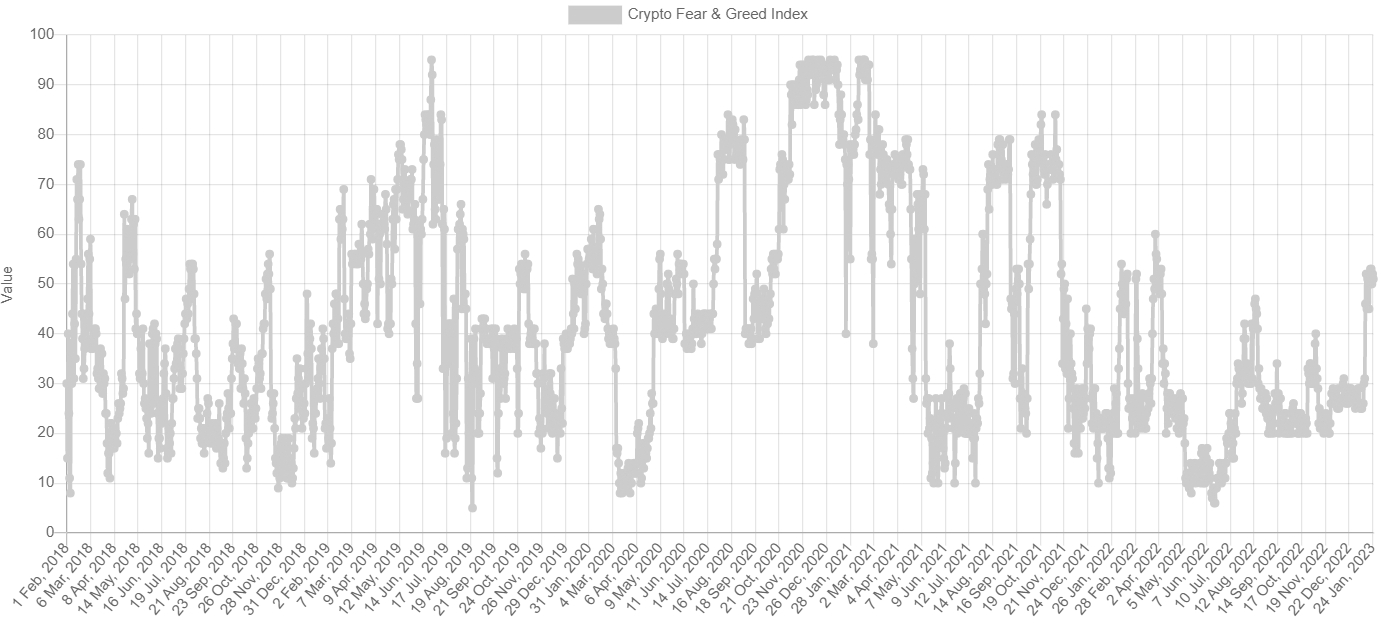

Elsewhere, the widely followed Bitcoin fear and greed index has returned to the neutral territory (i.e. above 50) for the first time after a prolonged spell of fear and extreme fear. A sustained recovery to neutral often occurs at the start of the next Bitcoin bull market, such as early 2019 or mid-2020.

An analysis by crypto-focused Twitter account @CryptoHornHairs made the startling observation that bitcoin has followed almost exactly the footsteps of the nearly four-year market cycle it has followed over the past eight years. After bottoming out in November, Bitcoin could rally for nearly 1,000 more days before entering the next bear market in 2025, the analysis suggests.

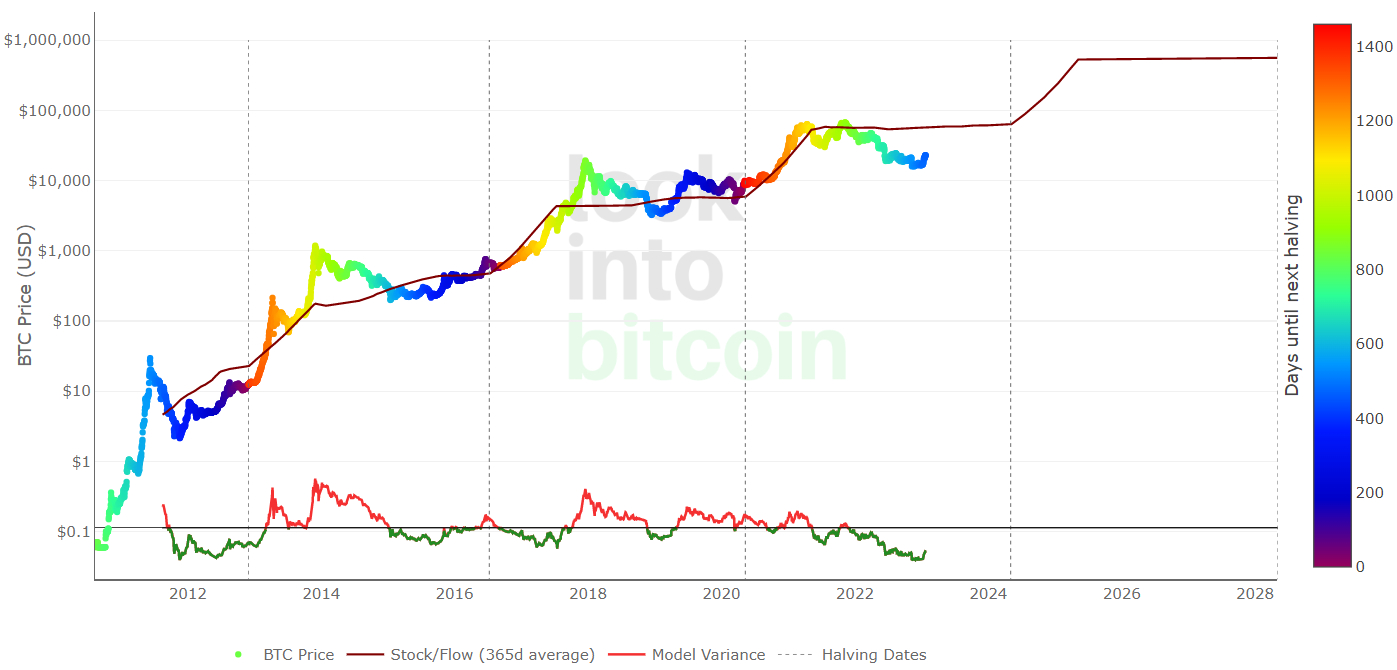

Bitcoin’s widely-held pricing model tells a similar story. According to Bitcoin’s Stock-to-Flow pricing model, Bitcoin’s market cycle is about four years, and prices typically bottom out near the middle of his four-year gap between “halvings.” is on. Bitcoin halving is his quadrennial phenomenon. The mining reward will be halved, thus lowering the Bitcoin inflation rate. Past price history suggests that Bitcoin’s next big rally will come after the next halving in 2024.