Would You like a feature Interview?

All Interviews are 100% FREE of Charge

For the first time since 2019, an on-chain indicator is giving a clear Bitcoin buy signal, according to crypto data analytics firm CryptoQuant.After falling below the Bitcoin market’s 365-day Simple Moving Average (SMA), It recently broke above the 365-day Simple Moving Average (SMA).

The Profit and Loss Index has chopped either side of the 365-day SMA in 2020 and 2021. After the last dip below the 365-day SMA, the last time it fell significantly below the 365-day SMA was in 2019, months after the market fell. bottomed. “The CQ PnL Index gave his BTC a definitive buy signal,” CryptoQuant noted, adding that “an index crossover suggests the start of a bull market in the past cycle.” .

Cryptoquant warned that “it is still possible for the index to fall again.” blog postHowever, Bitcoin bulls plan to add this indicator to their list of other on-chain and technical signals showing bullish signs.

Rise in List of On-Chain/Technical Indicators Says Bitcoin is Bottoming

As we discussed in a recent article, the increasing confluence of indicators tracked by Glassnode (examining eight pricing models, network utilization, market profitability, and wealth balance) is an indication that Bitcoin is emerging from a bear market. It suggests that he may be in the early stages of recovery.

And these aren’t the only on-chain indicators flashing signals that a bull market is coming. According to an analysis posted on Twitter by @GameofTrade_, six on-chain metrics, including Cumulative Trend Score, Entity Adjusted Dormant Flow, Reserve Risk, Realized Price, MVRV Z-score, and Puell Multiples, are the “long-term buys across generations. Seeking Opportunities”.

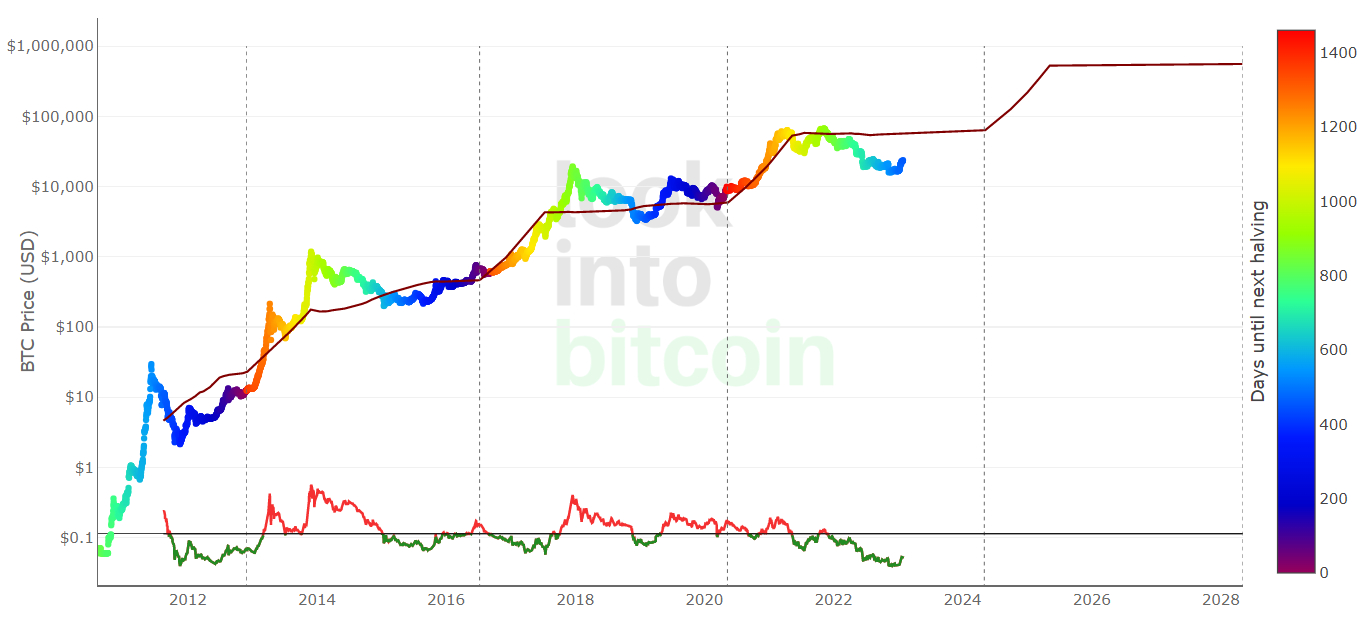

Meanwhile, an analysis of Bitcoin’s long-term market cycle also suggests that the world’s largest cryptocurrency by market capitalization may be in the early stages of a nearly three-year bull market. According to an analysis on his crypto-focused Twitter account @CryptoHornHairs, Bitcoin is precisely following the path of a roughly four-year market cycle that has now been fully respected for over eight years.

Elsewhere, the widely-advocated Bitcoin pricing model tells a similar story. , the price usually bottoms out near the middle of the four-year gap between halvings. Bitcoin halving is his quadrennial phenomenon. The mining reward will be halved, thus lowering the Bitcoin inflation rate. Past price history suggests that Bitcoin’s next big rally will come after the next halving in 2024.

But macro headwinds could push prices down this week

All the above indicators suggest that Bitcoin is currently an excellent long-term buy. It is important to emphasize “long term” here. That’s because the macro headwinds that have decimated the world’s largest cryptocurrency by market capitalization haven’t completely disappeared.

In fact, several macro strategists have identified this week’s key Federal Agency Policy Announcementsthere is a significant risk that the market may be underestimating the Fed’s determination to 1) continue to raise U.S. rates and 2) keep them high for some time.

Financial markets now expect the Fed to raise rates by another 50 bps. Once on Wednesday (4.50-4.75%) and once he’s in March (after which he peaks at 4.75-5.0%). The market then expects a full cut cycle to begin by the end of 2023.

Today, such market pricing is not ridiculous. U.S. inflation has fallen sharply and looks likely to return to the Fed’s 2.0% target soon, but multiple leading economic indicators suggest the economy could enter recession later this year. showing gender. The market view seems to be that the Fed wants to start easing to support growth.

And if market expectations of the economy are correct, the Fed will likely begin easing later this year. But judging by recent comments from officials, the Fed is not ready to suggest an easing bias. The 2021 “temporary” inflation debacle has severely undermined central bank credibility. The Fed wants to continue to signal its willingness to take a hardline stance on inflation.

Fed Chairman Jerome Powell et al. It could indicate that banks intend to push for another 50 basis points or more of rate hikes, which will shock markets, especially risk assets, in the short term. If that’s the case, Bitcoin’s massive January surge could stumble on February 1st.

Technicians have flagged a lack of major support levels prior to the $21,500 area and could easily be retested in such a scenario. A retest of $20,000 and his 200-day moving average and realized price just below should not be left out either. The most interesting thing is how Bitcoin reacts at such levels. Given all the above indicators that the bear market is over, many dip buyers may be eager to get their hands on Bitcoin at $20,000 again.