Would You like a feature Interview?

All Interviews are 100% FREE of Charge

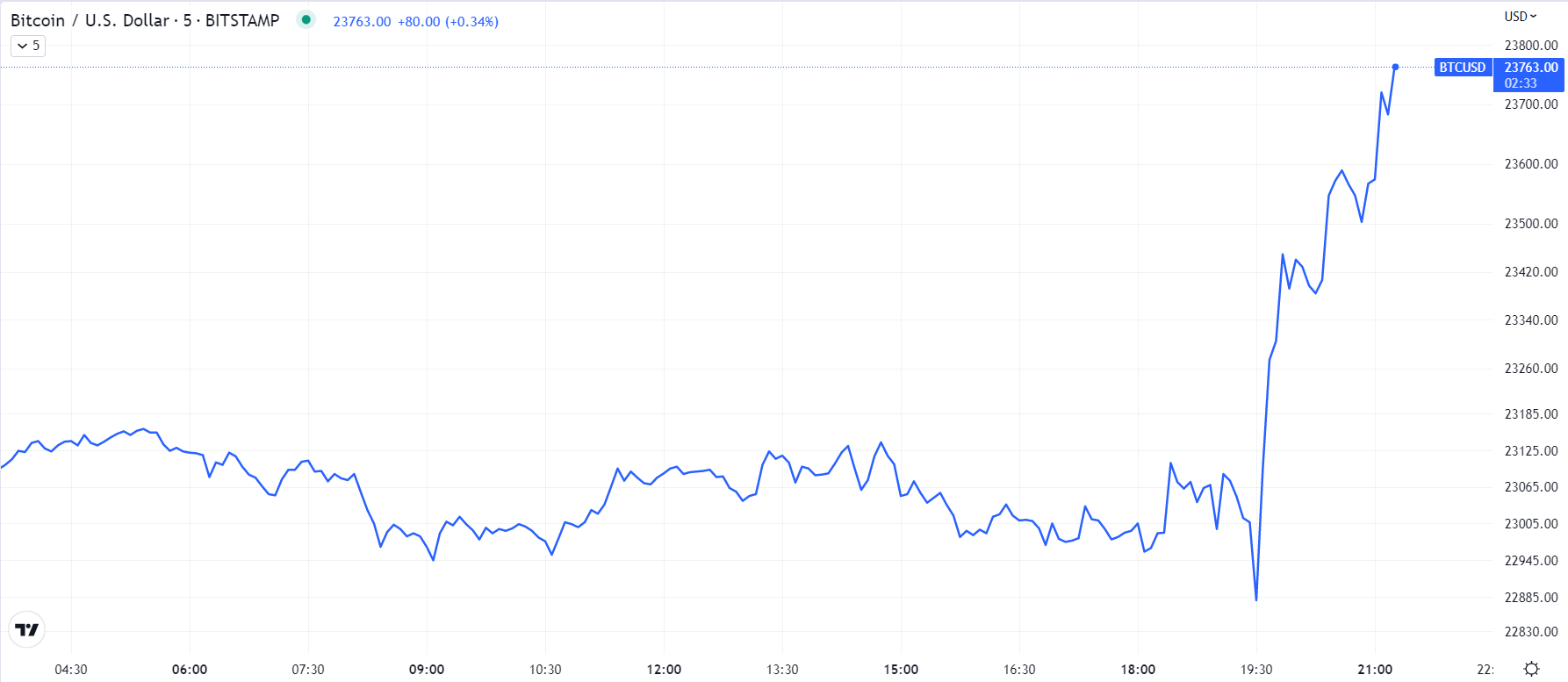

Cryptocurrency prices surged Wednesday after a more dovish-than-expected remark from Fed Chairman Jerome Powell, who spoke as usual at the Fed’s post-policy press conference. .Risk assets including stocksurged as Powell acknowledged that the central bank had made progress in fighting inflation, saying “the disinflationary process has begun.”

Chairman Powell’s comments came on the heels of the Fed’s announcement to raise the widely anticipated Fed Funds target range by 25 basis points to 4.50-4.75%. Bitcoin last traded near $23,700, but now he’s up nearly 2.7%, and he’s nearly 4.0% higher than the previous post-Fed lows in the $22,700 range. is rising to

Ethereum posted another impressive gain of over 3.5% in the $1,640s. The world’s second-largest cryptocurrency by market capitalization is now threatening an upward break in the short-term pennant structure, and could rise sharply towards resistance in the $1,800 region. Meanwhile, major altcoins such as Cardano, Solana, Polygon, and Polkadot are all up 4-8% compared to levels before the Fed’s policy announcement.

Powell missed an opportunity to bring the market down

Powell had a chance to oppose the recent easing of financial conditions (i.e., stocks and cryptocurrencies rose in January, while the U.S. dollar and yields fell). But the Fed’s focus is on long-term economic trends, not short-term market movements, he said.

Ahead of today’s Fed meeting, many strategists said Powell would step up harsh comments to dampen the market’s ‘animal spirit’, based on the assumption that the Fed does not want a premature easing in financial conditions. I warned you that it might. He is making their task of bringing inflation back to his 2.0% target more difficult.

As it happens, there weren’t any harsh words in there designed to trip markets, so the bounce of an asset like crypto. ‘ further rate hikes are likely to be justified. This could be at odds with the market’s base case that he will have just one more 25bps rate hike (in March) before the rate hike cycle ends.

Either way, cryptocurrencies seem to have the green light to rise in the short term. As such, short positions remain at risk and have been extinguished in the past few hours following the post-Fed crypto market rally on Wednesday. It shows a surge in liquidation of short positions, suggesting that the short squeeze can continue to support the market.

But if the US is headed for recession, can Crypto rise?

All smiles among crypto investors on Wednesday. But the post-Fed rally could quickly stall. Big tech companies like Meta Platforms, Amazon, Apple and Alphabet all report earnings for the next two days. And the fourth quarter earnings of the S&P 500 companies so far broadly point to the same thing: a decline in earnings.

This is largely due to the rapid slowdown in the US economy as a result of the delayed impact of an aggressive Fed rate hike cycle in 2022. Popular macro analyst Alfonso Pecatiello recently detailed in a Twitter thread why he expects a recession in the next four to five months.

Essentially, all major economic indicators such as the Global Credit Impulse, The Conference Board’s Leading Index, the Housing Market and the Philly Fed’s New Orders Index all point in this direction. A recession in the United States means that earnings slump for American companies is likely to worsen.

This risks preventing equities from benefiting from the optimism that the Fed will become less hawkish. Also, cryptocurrencies in general have been closely correlated with stocks in recent years. The question for investors, therefore, is whether cryptocurrencies can weather a US recession, even if economic weakness drives the Fed into a stronger dovish pivot.

Looking at the experience of the last few years, the answer may be yes. The 2020 pandemic lockdown has plunged the US economy into a short but deep recession. Cryptocurrencies are stronger than ever as the Fed eases interest rates to zero and the U.S. government launches an unprecedented fiscal stimulus after initial selling amid panic caused by the Covid-19 spread. I’m back.

Every cycle is different. The Fed is unlikely to bring interest rates to zero as quickly as in 2020. Nor does the US government have the ability to push for the kind of stimulus it did in 2020 and 2021. However, an easing of financial conditions in 2023 will support cryptocurrencies, even if it means that the US recession will not lead to an aggressive bull market as it did in the second half of 2020/2021.