Would You like a feature Interview?

All Interviews are 100% FREE of Charge

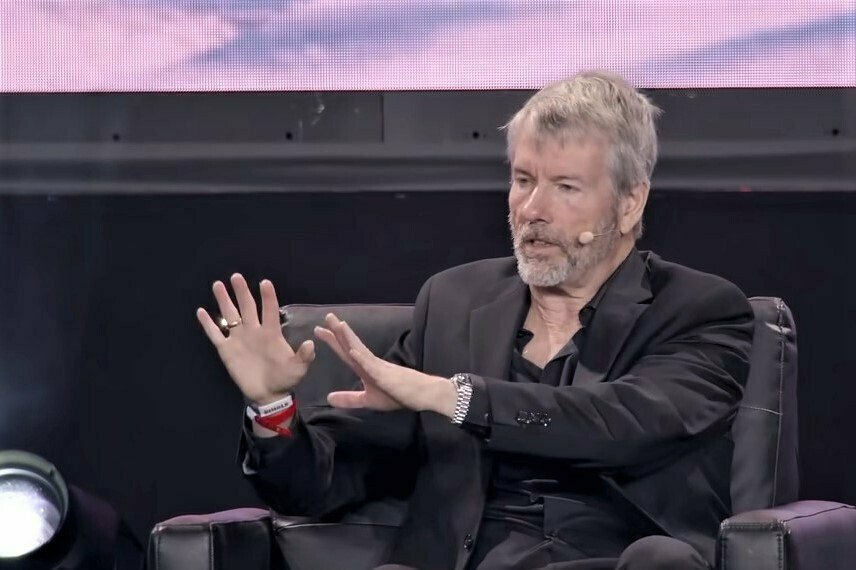

MicroStrategy co-founder and former CEO Michael Saylor has addressed Charlie Munger’s criticism of Bitcoin, claiming he hasn’t taken the time to understand it.

on friday interview Thaler told CNBC that he was “sympathetic” to Munger’s criticism of the broader cryptocurrency market, noting that thousands of altcoins are nothing more than a means of “gambling.” However, he argued that if Warren Buffett’s right-hand man had studied Bitcoin, he would have thought differently about it.

“If he was a business leader in South America, Africa, Asia and spent 100 hours studying the problem, he would be more bullish on Bitcoin than I was,” Thaler explained. added:

“Western elites didn’t have time to study…but I actually met people living in other parts of the world who weren’t enthusiastic about bitcoin and had an incentive to spend time thinking about it. I have never.”

The statement comes after Munger wrote an article in The Wall Street Journal calling for a blanket ban on cryptocurrencies. title”Why America Should Ban CryptocurrenciesThe article argued that cryptocurrencies are “gambling contracts” and urged regulators to act and introduce a regulatory framework.

“Cryptocurrencies are not currencies, commodities, or securities. Instead, they are gambling contracts with an almost 100% edge of the house, entered into in countries that are traditionally regulated only by competing states. Laziness,” Munger said in an op-ed.

This isn’t the first time Munger has attacked digital assets.formerly he Said Cryptocurrency trading is ‘just dementia’ and it’s called Bitcoin.”A bad combination of deception and delusion’ That’s good for kidnappers.

Notably, Warren Buffett, Chairman and CEO of Berkshire Hathaway, also shares the same view as his friend Munger on cryptocurrencies. call Bitcoin “rat poison squared” in 2018.

Meanwhile, Michael Thaler’s big bet on Bitcoin did not go as expected as the company reported huge losses in the fourth quarter of last year. MicroStrategy’s net loss for the fourth quarter hit his $249.7 million, a significant drop to his $197.6 million loss from the company’s Bitcoin investment strategy.

However, Thaler said in an interview with CNBC that he remains bullish on Bitcoin. He also details his MicroStrategy plans to develop Lightning enterprise software. “Microstrategy is actually developing our own enterprise his Lightning product, his MicroStrategy Lightning,” he said, adding:

“We want CMOs to deliver lightning rewards or bitcoin rewards like Frequent Flyer Programs to hundreds of thousands or millions of customers, all employees, and all prospects at the speed of light on websites. We’ll make it available — and we’re very enthusiastic about it.”