Would You like a feature Interview?

All Interviews are 100% FREE of Charge

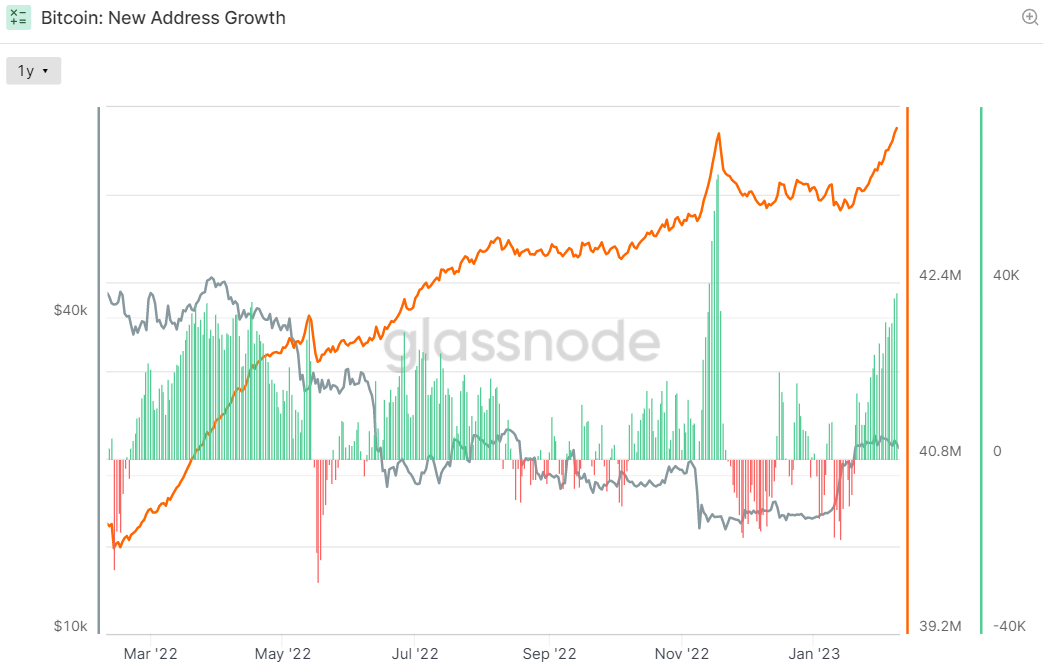

This week, the number of Bitcoin wallet addresses holding non-zero balances for the world’s first, most popular and largest cryptocurrency by market capitalization hit a record high. This suggests that global adoption of the Bitcoin network continues to drive despite the difficult bear market and market size in 2022. Grim global economic outlook for 2023.

The number of Bitcoin addresses with non-zero balances surpassed 43.8 million on Wednesday, according to data presented by crypto analytics firm Glassnode.th First time in January. This surpasses his all-time high of 43.76 million addresses recorded in mid-November 2022.

Back in November, FTX, formerly one of the world’s largest cryptocurrency exchanges, collapsed, resulting in customers losing access to billions of dollars in funds and a move towards self-custody of cryptocurrencies. A shift has been triggered. Investors rushed to pull bitcoin off exchanges, causing a surge in the number of addresses at the time.

However, with the price of Bitcoin dropping to 2022 lows and the contagion shaken by FTX’s bankruptcy, many wallets have disposed of all their Bitcoins, and non-zero address numbers are similarly rapidly disappearing. pulled back.

Amidst 1) optimism for a better macro environment in 2023 and 2) increasing on-chain and technical indications to attract enough new investors after the Bitcoin bear market is over. So, the Bitcoin price has risen about 40% since the beginning of the year. Back in the Bitcoin market, the number of non-zero wallet addresses has returned to record highs.

Increase in non-zero addresses due to the entry of small investors

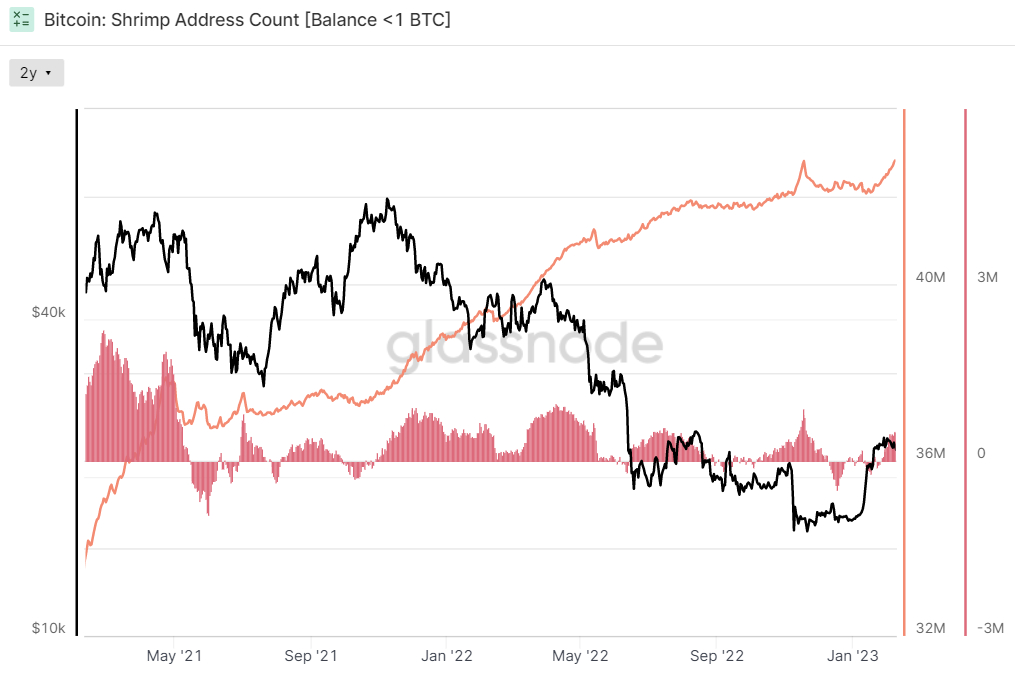

According to Glassnode data on the Bitcoin wallet address cohort, the recent surge in non-zero address numbers is (not surprisingly) driven by the proliferation of wallets holding small amounts of BTC. The number of so-called shrimp wallets holding less than 1 BTC hit a new record of over 42,827,000.

At the same time, the numbers of Crab, Fish, Shark, and Whale addresses holding 1-10, 10-1K, and 1K+ BTC respectively have all stagnated. The number of Crab, Fish and Shark wallets initially surged in the wake of the fall in Bitcoin prices after the collapse of FTX, with large investors taking advantage of the opportunity to buy the decline.

We can therefore conclude that the recent increase in the number of non-zero wallet addresses is accompanied by a turnover of Bitcoin ownership from large investors to small new investors. are much more likely to fall into the HODLer camp. In other words, people who buy BTC and hold it for the long term because they strongly believe in the prospects of cryptocurrencies.

Evidence is also accumulating that the Bitcoin market may be in the early stages of rotation from HODLers to new investors. This trend often coincides with the birth of a new Bitcoin bull market.

HODLers Begin Rotation To New Investors – What This Means For BTC

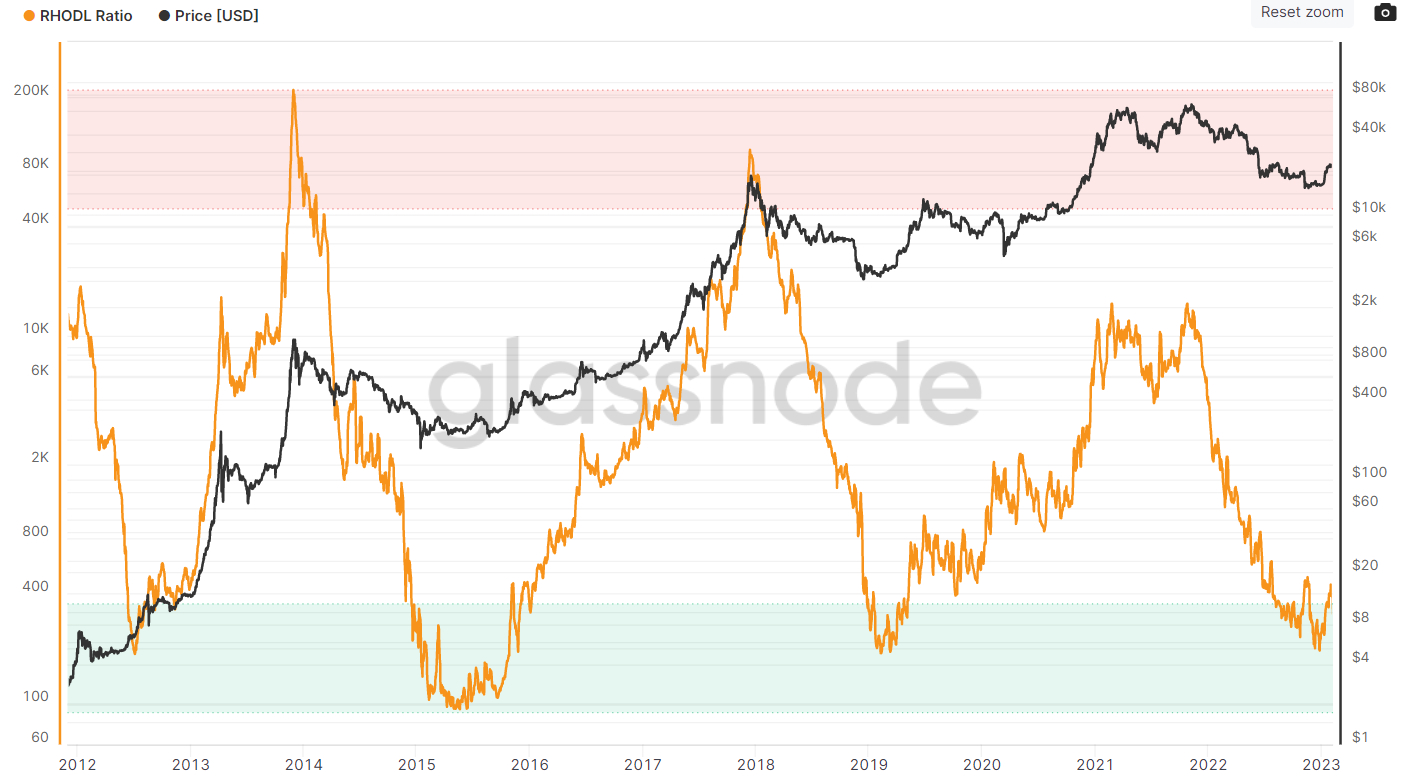

Glassnode’s Realized HODL Ratio (RHODL), the ratio of two Bitcoin age groups, appears to be in the process of bottoming out. RHODL is Bitcoin wealth between experienced and new investors calculated by comparing the number of coins bought within the past week to the number of coins that have not moved in a year or two. A gauge of the spread of the distribution of .

In late December, RHODL fell to its lowest level since the 2019 bear market, but has since rebounded significantly. As you can see from the chart above, RHODL rebounds are usually tied to Bitcoin price increases. RHODL has seen increased demand for his BTC from new investors due to increased participation in the Bitcoin market historically associated with long-term price increases. .

So does the increase in non-zero wallet addresses mean that the Bitcoin price will go up from here? Well, not necessarily. Non-zero address numbers rose (slowly) throughout most of 2022, but not enough to prevent a bear market. Demand from new dip-buying investors, as captured by the rising dominance of older coins in RHODL ratios, was not enough to prevent price declines as a result of short-term investor capitulation of weak hands. .

For the increase in the number of non-zero addresses to be a bullish sign, it would likely also have to be accompanied by evidence that BTC wealth is rotating to new investors, which certainly seems to be the case today. is.