Would You like a feature Interview?

All Interviews are 100% FREE of Charge

Bitcoin, which has dominated cryptocurrency inflows for most of the past week, caught the eye of investors last week.According to the latest weekly Flow of funds for digital assets Produced by crypto analytics firm CoinShares, the report tracks investment flows into and out of digital asset investment products. Bitcoin broke below $22,000 for the first time since mid-January last Thursday, ultimately dropping 5.0% last week.

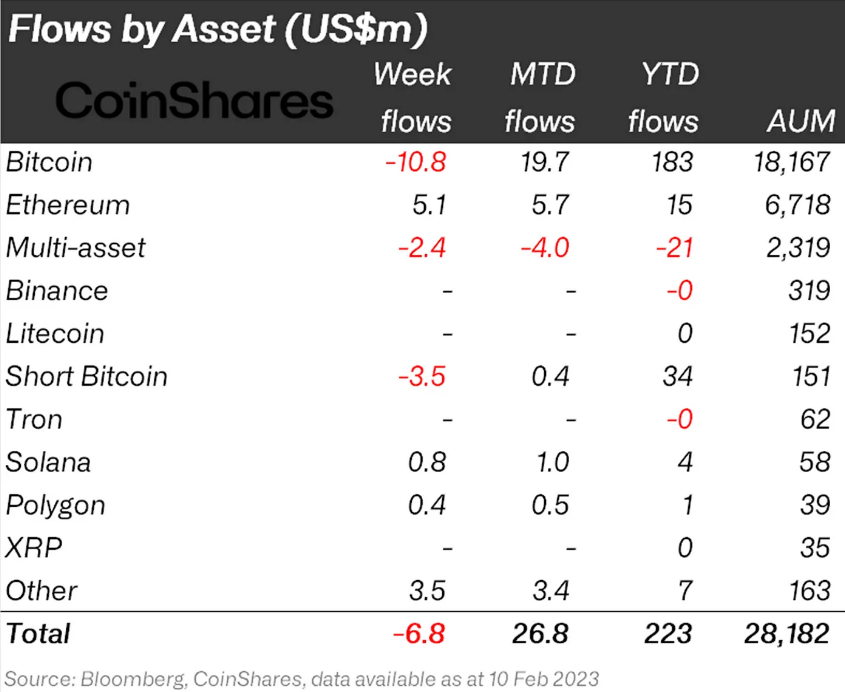

Bitcoin investment products posted net outflows of $10.9 million last week, while altcoin investment products posted net inflows of $3.9 million, according to CoinShares. Some investors appear to have taken advantage of recent declines to profit or cut losses on short positions following 2023 rally, draining his $3.5 million from short Bitcoin products. It is worth noting that

Ethereum is finally starting to feel the love. The world’s second largest cryptocurrency by market capitalization and the dominant decentralized finance/application blockchain infrastructure. became. It still lags far behind Bitcoin, with related investment products receiving an inflow of $183 million.

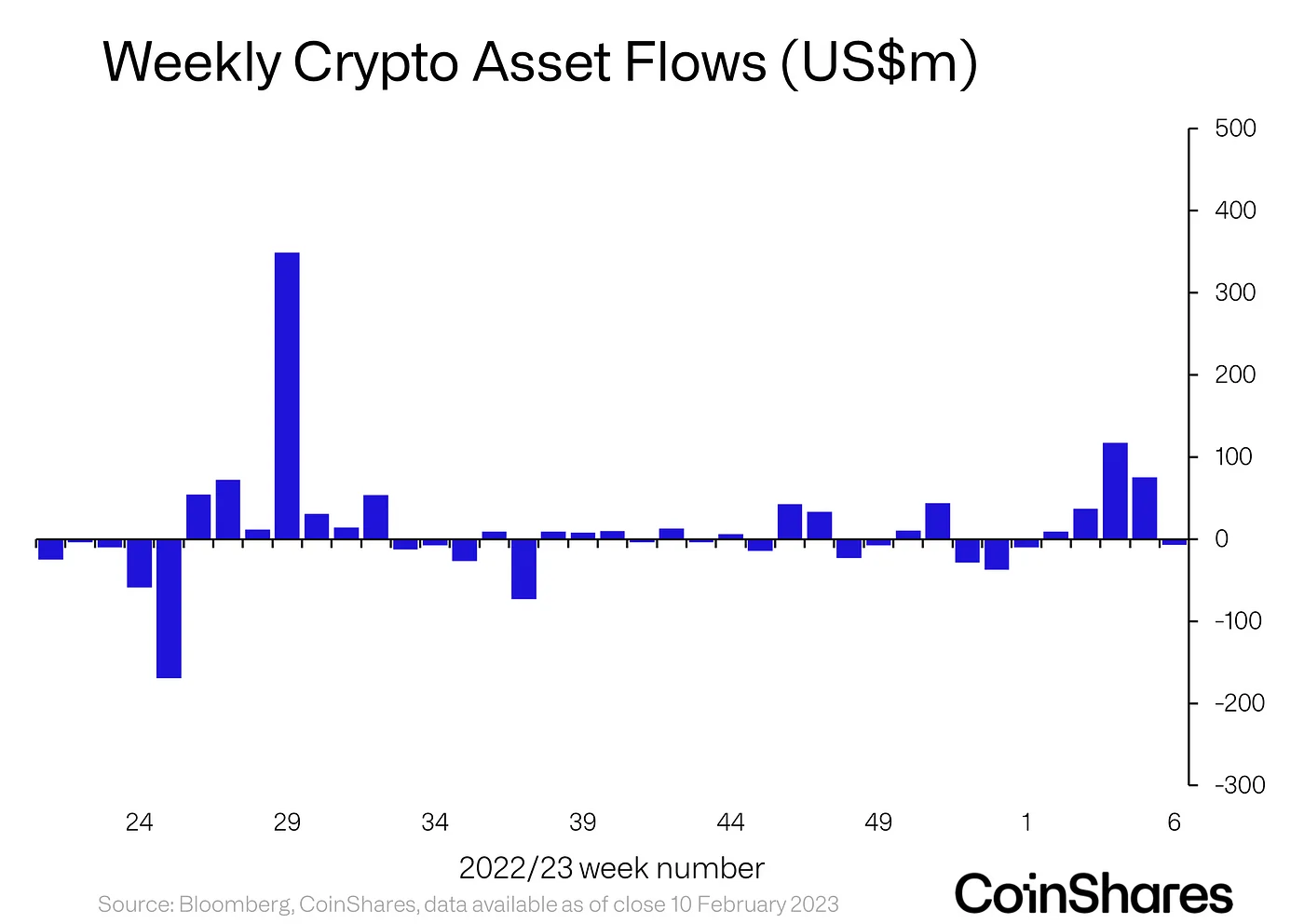

Net Crypto Exodus Driven by Fear of Fed Tightening

CoinShares attributed the $7 million net outflow of digital asset investment products to investors “shaken by the prospect of another rate hike by the US Federal Reserve.” The week before last, his PMI survey data for US employment and his ISM service both rose significantly in January, suggesting the US economy is still pretty hot, pushing forward rate hikes without triggering a recession. increasing his Fed’s confidence that he can.

Investors face another week of macro risk testing

Further outflows from digital asset investment products are likely this week if macro headwinds persist, making it easy to follow the previous footsteps. Crypto traders are watching Tuesday’s US Consumer Price Index (CPI) report nervously. Worryingly for crypto bulls, economists predict MoM inflation pressures will rise, and if confirmed, will worry Fed policymakers, pushing interest rates above 5.0% for some time. may strengthen the resolve to maintain

This could reinforce the recent upward trend seen in U.S. dollar and Treasury yields against most of the major G10 peers, which could weigh heavily on crypto. could push down towards the $20,500 support area (18th).th January low and 50DMA). A break below would open the door to a test of 200DMA and a realized price in the high $19,000s.

Crypto traders will monitor U.S. retail sales data on Thursday and signal hopes about a possible U.S. recession later this year. We are also paying attention to