Would You like a feature Interview?

All Interviews are 100% FREE of Charge

The cryptocurrency community is constantly looking for ways to bridge the gap between traditional finance and fiat currencies. A decentralized finance (DeFi) tool. The Crypto OnRamp platform is the primary way users can move between these two financial ecosystems.

However, a new report from Cointelegraph Research and crypto-based financial services provider Onramper reveals that 50% of fiat crypto transactions fail even after the completion of Know Your Customer.

In addition, the difficulty of the transaction process can result in transaction abandonment rates as high as 90% during the purchase flow.

The study looked at the 9 largest fiat currency onramps, including Coinify, MoonPay, Transak and Wyre.

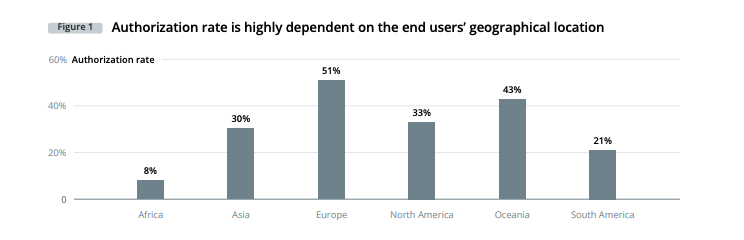

Data shows that different on-ramp performances vary greatly, but one of the main factors is user location. Europe has the highest transaction success rates, while Africa and South America have the lowest.

Other factors that influenced transactions on the crypto onramp included payment method, fiat currency used to convert to crypto, and available trading pairs. Bank transfers as a payment method have proven to have excellent transaction success rates, achieving close to 100% success in two instances.

Related: Credit Cards Can Bridge Web2 to Web3, Music Industry Executive Says

Additionally, transaction value is a key indicator of success, with smaller transactions worth $0-26 achieving a 66% approval rate.

This research concluded that a potential solution to the transaction authorization problem could be for token service providers to offer the broadest possible aggregated onramp in a single interface. Another is to dynamically route transactions to provide the best option for the user’s situation.

Recently at the World Economic Forum, Tether Chief Technology Officer Paolo Ardoino called the platform’s stablecoin Tether (USDT) a gateway to Bitcoin (BTC).

The Hong Kong Monetary Authority also explained that upcoming retail central bank digital currencies are a potential entry point into the DeFi space.